Roth Conversion Limits 2024. $7,000 if you're younger than age 50. A total contribution limit, which includes employer.

Less than $146,000 if you are a single filer. Here’s a closer look at the.

Is Converting To A Roth Ira The Right Move For You?

The irs only allows you to contribute $7,000 directly to a roth ira in 2024 or $8,000 if you're 50 or older.

$8,000 If You're Age 50 Or Older.

Not fdic insured • no bank guarantee • may lose value the charles schwab corporation provides a full range of.

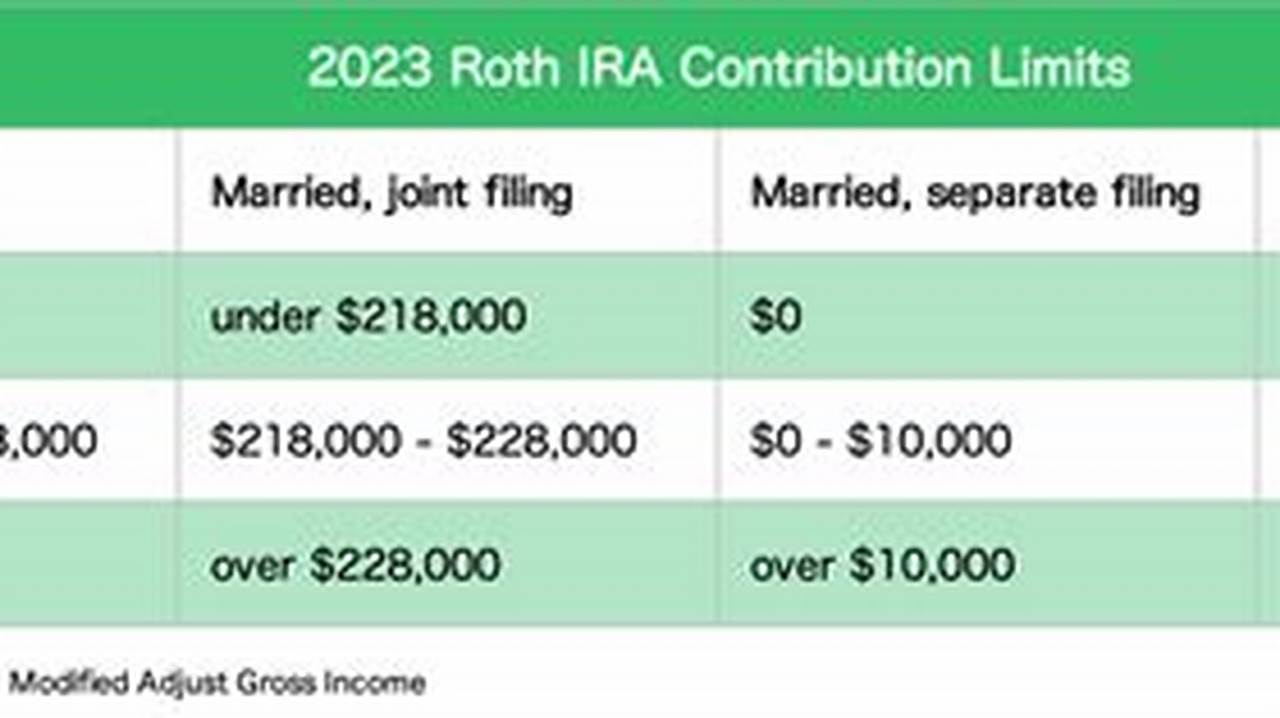

12 Rows If You File Taxes As A Single Person, Your Modified Adjusted Gross Income.

Images References :

A Total Contribution Limit, Which Includes Employer.

But other factors could limit how much you can contribute to your roth ira.

This Figure Is Up From The 2023 Limit Of $6,500.

Less than $230,000 if you are married filing jointly.

Should Your Client Wish To Open An Ira.